Worthwhile

Access our easy and rapid services anywhere. A single document completes your application

Access our easy and rapid services anywhere. A single document completes your application

A direct lender that values responsibility and innovation. We ensure your data's security and help in hard situations

Quick and simple, without the hassle. Instant fund transfers with extended loan options

Apply conveniently via our app with a straightforward form.

Expect a decision in as little as 15 minutes.

Accept your funds, normally transferred in about one minute.

Apply conveniently via our app with a straightforward form.

Download loan app

In recent years, the proliferation of loan apps in Kenya has revolutionized the way people access credit. These platforms offer quick and convenient solutions to individuals seeking to borrow money for various purposes. From emergency expenses to business investments, loan apps provide a digital alternative to traditional banking services.

One of the main advantages of loan apps in Kenya is their convenience and accessibility. With just a few clicks on your smartphone, you can apply for a loan from anywhere at any time. This eliminates the need to visit a physical bank branch and wait in long queues to submit a loan application.

Moreover, loan apps have streamlined the application process, making it faster and more efficient. Most apps require minimal documentation and provide instant approval, helping borrowers access funds quickly when needed.

Another benefit of loan apps in Kenya is the flexibility they offer in terms of loan options. These platforms cater to borrowers with diverse financial needs, offering a range of loan products such as personal loans, business loans, and payday loans. Borrowers can choose the loan type that best suits their requirements and repayment capabilities.

Compared to traditional lenders, loan apps in Kenya often offer competitive interest rates on loans. This can result in cost savings for borrowers, especially when borrowing large sums of money. Additionally, some apps reward borrowers with lower interest rates for timely repayments, promoting financial responsibility.

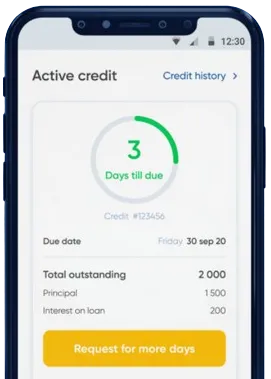

Most loan apps in Kenya feature a user-friendly interface that simplifies the borrowing process for users. These apps are designed to be intuitive and easy to navigate, allowing borrowers to apply for loans, track their repayment schedules, and manage their accounts seamlessly. In addition, many loan apps offer educational resources and financial tips to help users make informed decisions about borrowing.

Loan apps in Kenya offer a myriad of benefits to borrowers, including convenience, flexibility, competitive interest rates, and user-friendly interfaces. By leveraging these digital platforms, individuals can easily access credit, manage their finances, and achieve their financial goals efficiently. As the financial technology sector continues to grow in Kenya, loan apps are poised to play a significant role in driving financial inclusion and empowerment in the country.

Loan apps in Kenya are mobile applications that allow individuals to borrow money through their smartphones. These apps have simplified the borrowing process by eliminating the need for physical paperwork and long approval times.

Loan apps in Kenya typically require users to download the app, create an account, and provide personal and financial information. Once the information is verified, users can apply for a loan through the app and receive the funds directly to their mobile wallets or bank accounts.

Some benefits of using loan apps in Kenya include quick approval times, flexible repayment terms, and convenience. These apps also provide access to credit for individuals who may not have a traditional banking history.

Some risks of using loan apps in Kenya include high interest rates, hidden fees, and the potential for overborrowing. It is important for users to carefully read the terms and conditions of the loan before accepting it to avoid any unexpected charges.

To improve your chances of getting approved for a loan through a loan app in Kenya, make sure to provide accurate and up-to-date information during the application process. You can also improve your creditworthiness by paying off existing debts and maintaining a good credit score.

While most loan apps in Kenya are legitimate, there are some fraudulent apps that may scam users. It is important to do thorough research on the app and its reputation before providing any personal or financial information. Additionally, make sure to read reviews and feedback from other users to gauge the app's trustworthiness.